Chess Consumer Segments, Defined

Update 10/20/2022: Broadcast Viewership figures have been updated since publishing to include some missing data, as well as additional notes added for clarification of other data sets.

In order for chess content creators to maximize their growth potential, they need to better understand who is watching chess and using online learning tools. This post contains data which creators might use to better understand who is out there, where they are, and what they like. With the significant increase of creators in the landscape building their own followings, those with a more specific understanding of the available audience will have a competitive advantage in discoverability, retention, and monetization.

There are a ton more content creators in chess entertainment spaces (live streaming and on social media platforms) than there were pre-pandemic (the World Health Organization declared COVID-19 a pandemic on March 11, 2020). And not long after the WHO declaration, The Queen's Gambit (which debuted on Netflix on October 23rd, 2020) inspired many in quarantine to return to or discover chess as a safe hobby to pass the time. Data is presented later in this blog post to support this correlation by looking at trends in the Chess broadcast category on Twitch.

Note: This blog contains a LOT of data, so if you're not in the mood to go deep, you can skip to the TLDR section at the end! But I hope you'll choose to read through the whole thing because some of the findings are pretty cool. ![]()

Assumptions on Consumer Segments

How can the chess consuming audience be broken into useful categories? We can first attempt to make subjective assumptions based on existing genres of chess content as entertainment, and then conduct some concrete analysis of available data.

My subjective assumptions (based on personal experience) lead me to feel the following segments exist for consuming chess content as entertainment (which includes instructional video content, live streams, chess memes and lifestyle posts, news articles, and TV/movies):

- Non-players - Engages positively in memes and blunder clips, TV and movies, and some lifestyle posts, favors short-form video content on mobile platforms. Doesn't care for instructionals beyond perhaps trick openings, doesn't follow chess professionals or influencers directly.

- Beginners / Casuals - Investigates openings and uses early learning tools online, follows accounts of individual streamers on social media, skewed towards lifestyle and personality, watches online tournament coverage of influencer chess events like Pogchamps.

- Intermediate / Club players - Analyzes their own games, follows professional chess players on social media, watches over-the-board and online tournament commentary coverage (top FIDE events and online tournaments of professional players).

- Advanced / Professionals - Publishes instructional content, solicits support for professional pursuits, coaches privately. Not much content consumption as entertainment beyond commentary coverage of top events, posts on Twitter to stay in public view.

Let's use some real data to test these ideas about where the separations probably exist. We can use online chess rating as the first dividing factor, and then see what kinds of learning tools they actually use most frequently (or causes them to re-engage when retention marketing is employed). We will also look at overall demographics on live stream viewership and preferred social media platforms.

Rating Distributions

The following data set looks at Chess.com's active users from June 24th to September 22nd, 2022 (a 90 day period).

| BULLET RATING | % | BLITZ RATING | % | RAPID RATING | % |

| Above 200 | 29% | Above 200 | 28% | Above 200 | 28% |

| Above 400 | 25% | Above 400 | 24% | Above 400 | 25% |

| Above 600 | 19% | Above 600 | 19% | Above 600 | 19% |

| Above 800 | 12% | Above 800 | 13% | Above 800 | 13% |

| Above 1000 | 7% | Above 1000 | 8% | Above 1000 | 8% |

| Above 1200 | 4% | Above 1200 | 4% | Above 1200 | 4% |

| Above 1400 | 2% | Above 1400 | 2% | Above 1400 | 2% |

| Above 1600 | 0.9% | Above 1600 | 1% | Above 1600 | 0.7% |

| Above 1800 | 0.4% | Above 1800 | 0.5% | Above 1800 | 0.3% |

| Above 2000 | 0.2% | Above 2000 | 0.2% | Above 2000 | 0.1% |

We could potentially categorize users based on rating in the following way:

- Beginner (Below 1000): 85%

- Intermediate (1000-1600): 13.4%

- Advanced (1600-2000): 1.2%

- Expert (2000+): 0.1%

A key takeaway from this is that more than 95% of active Chess.com users are below 1400 rating among all time control categories, and over 85% fall under the Beginner segment, a critical insight for content creators.

Product Engagement

Among retention campaigns targeting mobile users (in the form of push notifications) who engaged with a product in the past and then went inactive, the products which received the highest rates of retention success were Puzzles (7% clickthrough on average) and Lessons (6% clickthrough). This suggests that creators who make content around puzzles and lessons may have a higher engagement rate compared to other instructional genres.

A comparison of how many lessons and puzzles users have completed (all time) also provides some insights.

Puzzles Completed (from a sample size of over 24 million accounts)

- 1: 26%

- 5+: 22%

- 25+: 15%

- 50+: 13%

- 100+: 10%

- 250+: 7%

- 388+: 6%

Lessons Completed (from a sample size of over 6 million accounts)

- Less than 5: 25%

- 5+: 28%

- 10+: 20%

- 15+: 15%

- 25+: 8%

- 50+: 4%

- 100+: 1%

An interesting insight here that isn't apparent from just showing percentages is that more individual users have completed at least 250 puzzles versus those who have completed between 5 and 14 lessons, at a difference of over 400,000 users.

Broadcast Viewership

Here are some stats to support correlations between the two turning points mentioned earlier (COVID and The Queens Gambit) and increased consumption of chess as entertainment (Source: https://www.Sullygnome.com).

Hours streamed in the chess category on Twitch (rounded):

- 2017: 46,707 hours

- 2018: 145,412 hours

- 2019: 193,305 hours

- 2020: 519,225 hours

- 2021: 906,876 hours

Average viewers in the chess category:

- 2017: 383

- 2018: 1,529

- 2019: 2,370

- 2020: 8,410

- 2021: 15,937

Hours watched (viewership):

- 2017: 3 million hours

- 2018: 13 million hours

- 2019: 20 million hours

- 2020: 73 million hours

- 2021: 139 million hours

(Increases between 2017 and 2018 may be attributed somewhat to Chess.com's efforts to stream more live over-the-board coverage in 2018 than in years prior.)

Rating Ranges of ChessTV Viewers

An interesting data set to consider are the rating ranges of people who watch broadcasts from Chess.com's Twitch embed page, chess.com/tv, to see if we can link our majority age range of broadcast viewers with skill levels. We will use Rapid as the time control we review, as it presents the largest sample size of over 150,000 users (though Bullet and Blitz time controls also curve in the same manner).

| Rapid Rating | % |

| Above 200 | 21% |

| Above 400 | 20% |

| Above 600 | 18% |

| Above 800 | 14% |

| Above 1000 | 11% |

| Above 1200 | 7% |

| Above 1400 | 4% |

| Above 1600 | 2% |

| Above 1800 | 1% |

| Above 2000 | 0.5% |

We see that over 90% of users watching ChessTV are rated under 1400, which falls in line with the overall user base on the site, which sits at 95% being under 1400. Now let's see the age ranges of viewers who are watching directly on Youtube and Twitch.

Broadcast Audience Demographics

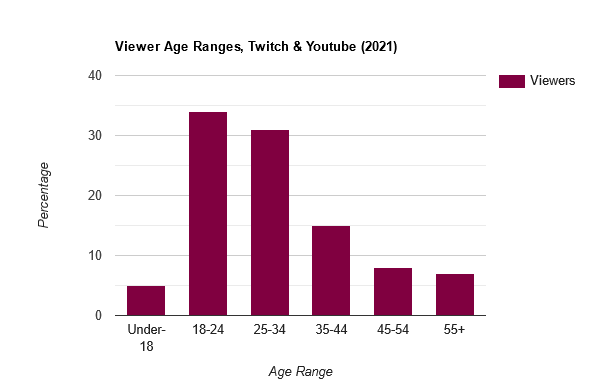

Viewer Age Ranges (Chess.com's Twitch and Youtube combined), 2021:

- Under 18: 5%

- 18-24: 34%

- 25-34: 31%

- 35-44: 15%

- 45-54: 8%

- 55+: 7%

Viewers of Chess.com's Pogchamps influencer tournament on Youtube (Quarterfinals on June 22, 2020) by Age:

Note: Pogchamps based on VOD views, since there are no age demographics available for that stream on Twitch.

- 13-17: 4%

- 18-24: 47%

- 25-34: 38%

- 35-44: 7%

- 45-54: 4%

- 55-64: 0.2%

- 65+: 0.2%

Viewers of Chess.com's Speed Chess Championship tournament on Youtube (Final on December 19, 2021) by Age:

Note: Based on views within the first 24 hours of the broadcast.

- 13-17: 2%

- 18-24: 33%

- 25-34: 39%

- 35-44: 14%

- 45-54: 6%

- 55-64: 3%

- 65+: 2%

Viewers of Chess.com's coverage of the FIDE World Chess Championship on Youtube (Final round on December 10, 2021) by Age:

Note: Based on views within the first 24 hours of the broadcast.

- 13-17: 2%

- 18-24: 32%

- 25-34: 37%

- 35-44: 15%

- 45-54: 7%

- 55-64: 4%

- 65+: 3%

So now let's shift to learning more about the social media landscape, in order to try to predict where they also engage with chess content and which types of content they would prefer.

Worldwide Social Media Networks, Ranked

According to Statistica's reporting in January of 2022, the top 10 most popular social networks worldwide (messaging apps excluded) ranked by number of monthly active users, is as follows:

- Facebook: 2.91 billion

- Youtube: 2.56 billion

- Instagram: 1.47 billion

- TikTok: 1 billion (combined with Douyin: 1.6 billion)

- Sina Weibo (Chinese micro-blogging app): 573 million

- Kuaishou (Chinese short form video app): 573 million

- Snapchat: 557 million

- Pinterest: 444 million

- Twitter: 436 million

- Reddit: 430 million

It is worth noting that although Twitter ranks 9th in worldwide activity, the chess community engages heavily on the platform.

Preferred Social Networks by Age Range

A breakdown of preferred social media platforms based on age range, compared to Chess.com's viewership age ranges, might provide the last key insight needed to determine the largest funnels available for creators to distribute their content. According to Datareportal.com's July 2022 report:

- Ages 16-24: Instagram. Second to that is TikTok (among females) or Facebook (among males).

- Ages 25-34: Instagram (among females) or Facebook (among males).

- Ages 35-44: Facebook. Second to that is Instagram.

- Ages 45-54: Facebook. Second to that is Instagram.

- Ages 55-64: Facebook. Second to that is Instagram.

Another useful insight is a ranking of mobile apps based on total number of downloads (between April and June 2022, Source Datareportal).

- Tiktok (including Douyin)

- Snapchat

And Datareportal also provided survey results on what activities are most popular on which social platforms, gathered in July 2022. Respondents were active users of each social media platform aged 16 to 64 who have used one of the platforms at least once in the previous month (note that among this age range, people worldwide use an average of seven social media platforms actively every month, based on responses in a similar survey).

- Facebook: "Message friends and family." Second to that is "Post or share photos or videos."

- Instagram: "Post of share videos." Second to that is "Follow or research brands and products."

- LinkedIn: "Keep up to date with news and current events."

- Pinterest: "Follow or research brands and products."

- Reddit: "Look for funny or entertaining content." Second to that is "Keep up to date with news and current events."

- Snapchat: "Post or share photos or videos." Second to that is "Message friends and family."

- TikTok: "Look for funny or entertaining content."

- Twitter: "Keep up to date with news and current events." Second to that is "Follow or research brands and products."

Which apps have the largest audience overlap? The survey provides the following data, and though this information is more granular than we probably need to define chess consumer segments at this time, it's still potentially useful for creators to know which platforms they could focus on if they intend to publish to more than one.

- 79% of Facebook users also use Instagram, and 74% also use Youtube.

- 79% of Youtube users also use Facebook, and 78% also use Instagram.

- 83% of Instagram users also use Facebook, and 77% also use Youtube.

- 84% of TikTok users also use Facebook, and 79% also use Youtube.

- 89% of Snapchat users also use Instagram, and 84% also use Facebook.

- 88% of Twitter users also use Instagram, and 83% also use Facebook.

- 83% of Reddit users also use Instagram, and 82% also use Facebook.

Resulting Strategic Insights (the "TLDR")

Based on all this data, we can try to make the following behavioral statements and correlations:

- Beginners are the largest active segment on chess sites by far (those at or below 1000 rating).

- People aged 18-24 watch the most live chess streams, are mostly male and in North American and European time zones, use Instagram and Facebook, and have high overlap with most other popular social apps. They engage with shared video content and brands more than news and current events.

- Influencer events like Pogchamps are favored by age range 18-24, whereas coverage of professional events like the Speed Chess Championship (online) and the World Championship (over the board) are favored by 25-34, suggesting that the 18-24 audience prefers to watch beginners and celebrities compete rather than professionals.

- The hypothesis posed earlier of the kinds of chess content they consume fall in line with those correlations: that they favor Puzzles and Lessons, follow accounts of individual streamers on social media, skew towards lifestyle and personality content, and watch online tournament coverage of influencer chess events like Pogchamps.

Although Instagram and Facebook are the most popular social apps, other platforms like Youtube and TikTok should still be considered by creators for their high discoverability and passive monetization structures, as well as Twitter specifically for its high engagement among the chess community. A holistic view of the discoverability, engagement, monetization, and presence of target audiences should guide creators' strategies, rather than any single metric.

Content creators of all kinds have the difficult task of focusing their content to a specific subset of a community, while also needing the top of their traffic "funnel" to be as wide as possible. Based on the results of this research, my conclusion is that chess creators should focus on the following subset of the chess community, being the widest funnel among them:

- Focus on an 18-34 age demographic,

- Puzzles and lessons at a Beginner level (under 1000 rating),

- Use Facebook and/or Instagram for posting lifestyle and sales/brand oriented content, Youtube for long-form instructional content, TikTok for short-form humor and lifestyle content, and Twitter for community news and discourse.

- Post at times of day based on peak social media usage for North American and European users.

Let me know in the comments what you think! ![]() Were you surprised by any of the statistics?

Were you surprised by any of the statistics?

Also, consider subscribing to my Marketing Made Easy channel on Youtube to learn more about how to apply marketing techniques to maximize your side-hustle or creator business.